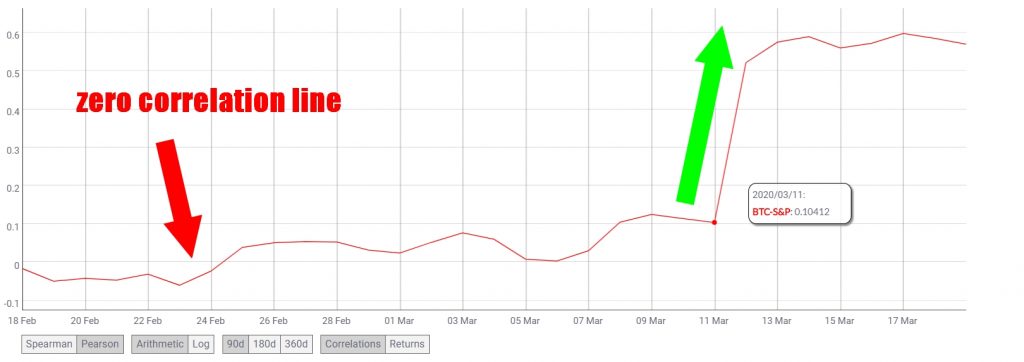

Most markets have crashed since the corona outbreak has affected Europe and the US. Many people see the crash in Bitcoin and Gold as clear evidence that those types of cash are no safe havens. When general markets crash, Gold usually goes down.

The simple logic that markets go down because people don´t like the asset, does not apply. Many people or bots trade options on the price or the volatility of an asset. They don´t physically hold any Gold or Bitcoin.

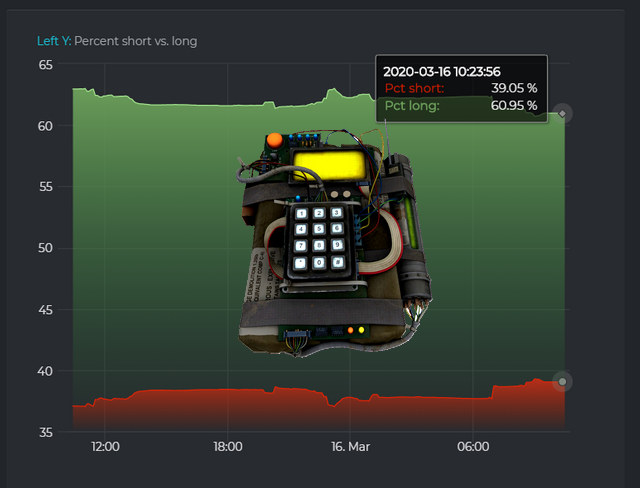

When there are lots of leveraged short positions and the stock market suddenly correlates with the Bitcoin market in an upward trend, those positions get liquidated and the price pumps. So the price does not pump because people are bullish and it does not drop because people are bearish and suddenly think Bitcoin is a bad store of value.

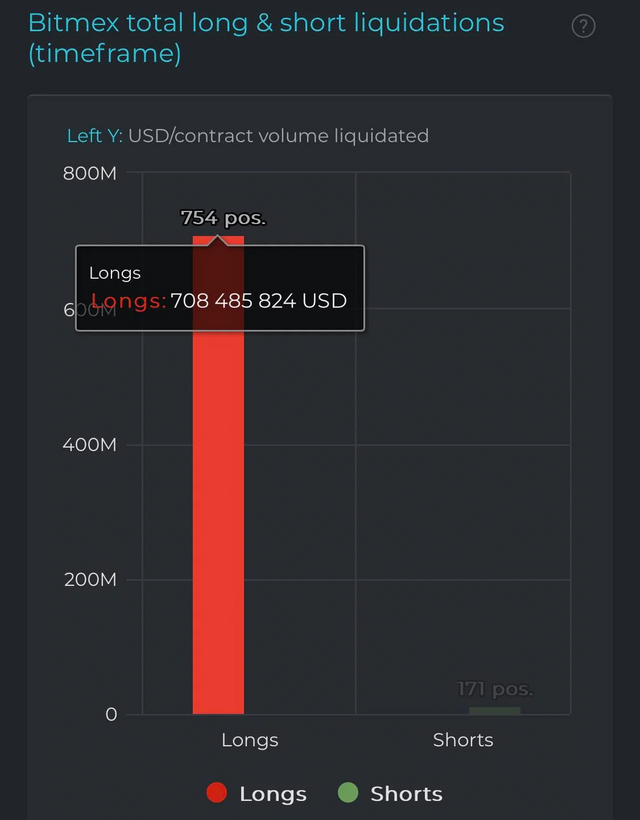

When there are lots of long-positions and when due to a stock-market crash the S&P500 suddenly starts to correlate with Bitcoin…well, then of course the price of Bitcoin will also crash. Leveraged options are like bombs, they can blowup and pull down the whole market without a single person thinking “hmm, today I should sell Bitcoin, because orange coin bad”. This is NOT how it works!

Bitcoin and Gold are still what they are. One BTC is one BTC and one ounce of Gold is one ounce of Gold.

- ✅ Bitcoin and Corona Virus – how it affects your coins

- ✅ Check out these other 3 powerful Tools to earn crypto instead of betting your money

- ✅ Already have a blog? Monetize it with these passive crypto income methods